Saturday, May 28, 2011

First Photo

7pm tonight is the wedding of my oldest daughter, Rachael to Brandon.

Yesterday was the rehearsal and rehearsal dinner which included among others:

Rachael's brother Josh and his wife Madeline, and her sister Tiffany and husband Jon along with the yet to be born, 5 days overdue, Calvin.

Jon & Tiff were spending the weekend at our house for the wedding when at 12:45 in the night, Tiff's water broke, and they headed back to Indy.

7 hours later, Calvin made his appearance, just before 8am:

The weekend, and month continues.....

Fort Wayne Site of the Day

I am breaking a rule.

Which I can do, since I set the rules for this website.

365 days a week I feature a Fort Wayne based website. This year it will be 364 days, because today is my daughter's wedding day and I'm featuring a site from her bridesmaid Jessie.

Jessie and my daughter Rachael met at Purdue.

Jess is now an accomplished and published photographer who moved back to the midwest this summer and is in the Fort Wayne area this weekend.

Amazing work Jess. Click on Pic.

Friday, May 27, 2011

Frugal Friday Part 4

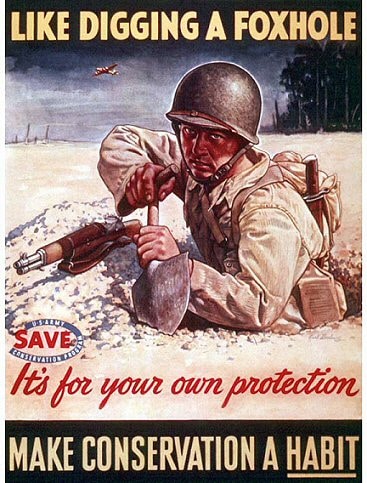

My hope is that you found one, two or more ideas from this list from the Art of Manliness blog.

-

Win the War on Debt: 80 Ways to Be Frugal and Save Money

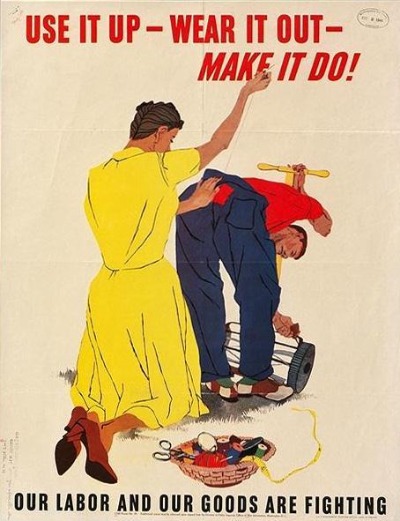

The manliness of frugality cannot be overstated. Frugality cultivates the manly qualities of independence, self-reliance, self-sufficiency, simplicity, and minimalism. It keeps a man free from the enslaving chains of debt and gives him an sense of manly pride and satisfaction. Frugality build a man’s immunity to the siren call of “stuff,” helps him learn to make do with less, and adds pleasure and happiness to his life by providing opportunities to practice delayed gratification. Frugality also fosters the DIY spirit and inspires a man to create, instead of consume.

We could wax long and poetic about the manliness of frugality but let’s get down to the brass tacks: how does a man become frugal? Some men, inspired to jump on the frugality wagon, set a drastic course for themselves and turn theirs live inside out. But inevitably, this man ends up chafing at the extreme constrictions he has set for himself, burns out on the program, and sets off on a shopping spree to compensate for the months of rigid restraint. No, the better course is simply to make little changes throughout the different areas of your life. You will be surprised to see how fast these small changes can add up and leave you with extra moola in your pockets and in the bank. And you also might be surprised to find out how fun being frugal is–really! It becomes like a game where you’re always trying to figure out ways to cut costs.

We’ve created this list of 80 practical–and often pretty painless–ways to save money. Whether you’re looking to trim your debt, live more simply, start an emergency fund, or just need to find ways to offset the hole in your budget created by rising gas prices, there are guaranteed to be a few things here you can start implementing in your life right away. I recommend giving these ideas a look-0ver, making a list of ten of more things you can give a go, and putting them into practice as a new month begins.

Victory over debt is at hand!

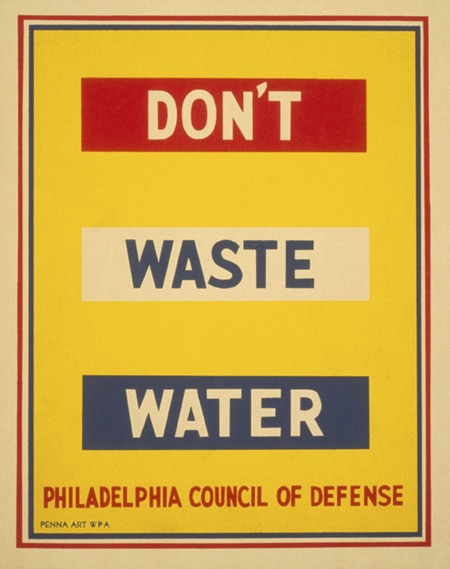

Utilities

55. Regularly clean the coils on the back of your refrigerator. A clean coil uses less energy.

56. Keep your freezer full. An empty freezer requires more energy to keep cold. If you don’t have anything to put in your freezer, fill up milk jugs with water and pack them in your freezer to take up space.

57. Kill the electricity phantom. Whenever you leave a device plugged into a wall socket, it continues to constantly draw a small amount of energy. All those plugged in appliances can take a toll on your electric bill.

58. Seal energy leaks. Energy leaks in your house make your heater and A/C work harder to maintain the temperature of your home. And the harder your central heating and cooling systems have to work, the more money you have to spend. Spend a weekend finding and sealing any energy leaks.

59. If you have a cell phone, get rid of your land line.

60. Put on a sweater or open up a window. Heaters and air conditioners can use a lot of energy to keep your house warm or cool respectively. If you’re feeling chilly, put on a sweater before you turn up the thermostat. If you’re feeling warm, open up a window. Fresh air makes you feel a lot happier too.

61. Turn off the lights. It’s a not a big thing, but every little bit helps. Follow your mom’s advice. Turn the lights off when you leave a room.

62. Use compact fluorescent bulbs or LEDs. I include this suggestion rather begrudgingly. I’m not a fan of the light that CFLs or LEDs give off. It’s flat and reminds me of being in a hospital. Give me the warm glow of an incandescent bulb any day. But I can’t deny the energy savings of CFLs and LEDs. Although they cost a little more than regular bulbs, they last up to 10 times longer and use up to 75% less energy than incandescent bulbs.

63. Plant shade trees. According to the U.S. Forest Service, “Trees properly placed around buildings can reduce air conditioning needs by 30 percent and can save 20 — 50 percent in energy used for heating.” If you can, plant some trees on the side of the house that gets the most sun.

64. Install aerating, low-flow faucets and shower heads to limit your water usage.

65. Lower the Water Heating Temperature. For each 10 degree reduction in water temperature, you can save between 3%-5%. 120 degrees is probably hot enough for most homes.

66. Put an insulator around your water heater. If your water heater needs it, surround it with a water heater insulator. That move right there can save you around 4%-9% in water heating costs.

67. Winterize your home. Winterizing your home makes your place more energy efficient so you can keep your family warm and toasty in the cold weather months without breaking the bank on energy bills.

Gift Giving

68. Make your own gifts. Brew some beer, make a birdhouse, or create a secret book safe. Use your imagination and your craftsmanship.

69. Offer to give a service, like mowing someone’s lawn each week for the entire summer instead of buying stuff. You can also put together a coupon book for someone like your wife, with coupons redeemable for things like “one free back rub.”

The flylady.com has many more cheap and free gift ideas for men, women, and children.

Miscellaneous Advice

70. Buy quality. Sometimes we get a little guff for promoting top-dollar products like Saddleback bags. Isn’t buying such expensive things incompatible with frugality? No, actually. Frugality isn’t about being cheap. It’s about getting the best value, and sometimes that means paying more to save more. It’s important to think about things in terms of cost-per-use as opposed to total cost. Let’s say you buy a pair of cheap boots for $50, and they’re neither comfortable nor particularly good looking, and so you only wear them when you have to which is once a week before they wear out in three years. The cost-per-wear on the “cheap” boots is thus 32 cents. Now, let’s say you spend $350 on a pair of top-quality, truly well-made boots. They’re really handsome, and you wear them every chance you get, which is four times a week. And they last you 50 years (with maybe a re-soling here and there). The cost per wear on the “expensive” boots is 3 cents. 3 cents! So which is the more frugal choice? This is a truth your grandpa knew well and why he actually had stuff to pass down to you.

71. Use it up, wear it out, make it do, or do without. It’s a creed your grandpa and grandma lived by to get through the Great Depression, and it’s just as applicable today. I get a lot of satisfaction from trying to make my stuff last as long as possible. Particularly with clothes. Pants come open up at the seam? Sew them back up. T-shirts too ratty to wear in public? Turn them into dust rags.

72. Foster a DIY mentality. Before spending money on hiring somebody to do a job for you, see if you can figure out how to do it yourself. When money’s tight, you can always use your other stash of equity: your time. Not only will doing things yourself save you money, but there’s a satisfaction and pride you get from being self-reliant. Of course, be careful with this advice. If it looks like it’s a job you can’t do or if screwing it up would cost you more money to fix, hire somebody to do it.

73. Be your own man. A big reason people spend money is social pressure. Don’t let others dictate how you’re going to live your life or spend your money.

74. Read up on personal finance. Knowledge is power. I subscribe to several personal finance blogs. Many of them post tips on thrift and frugality. My two favorites? Get Rich Slowly and The Simple Dollar. And I recommend checking these books out from the library: Your Money or Your Life by Joe Dominguez and Vicki Robin and The Total Money Makeover by Dave Ramsey.

75. Have a 30 day waiting period for big purchases. If you see something that you think you just have to have, before you hand over your credit card to buy it, put it on a “I’ll buy this in one month” list. If after one month you still think buying the item would be worth it, then get it. In my experience, after waiting a month you often realize you really don’t need it, so you save the money you would have spent. Score! And if you do end up getting it a month later, the power of delayed gratification makes the purchase more enjoyable than it would have been had you just bought it immediately. Score!

76. Use cash. In my experience, I tend to spend less when I use cash for most of my purchases. There’s just something about the tangibility of cash as opposed to debit cards that makes it hurt more to part with your money. When Kate and I were in hardcore debt repayment mode, we used the envelope budget system.

77. Learn to haggle. We’ve got a great post on this important skill coming next month.

78. Buy staples in bulk. Buying in bulk cuts down on the cost per usage. If there are items in your house that you use regularly, buy them in huge quantities. Diapers, baby wipes, trash bags, paper towels, soap, etc.

79. Don’t enroll in your bank’s overdraft protection program. At first blush, it might seem like a good idea; overdraft protection means that if you go to make a purchase with your debit card, and you don’t have enough money in your account to complete the transaction, the bank will “loan” you the money…and charge you a $25-$35 fee for their generosity. But that’s a big price to pay to avoid the embarrassment or inconvenience of having your card declined. And these fees can add up fast, because here’s what many consumers don’t know: most banks will purposefully process your largest transactions first, and then your smaller transactions after that. So let’s say you have $285 in your checking account and you buy a coffee for $3.50 in the morning, a sandwich for $5 at noon, and then some college textbooks in the afternoon for $300. The banks will process the $300 transaction first, thus depleting your account, and then charge you another $35 fee for the coffee and for the sandwich, and bill you for $105 in overdraft fees. Banks used to automatically enroll their customers in overdraft protection programs, but a court ruling last year made that illegal. But it was a big money maker for banks, so they still aggressively try to get you to sign up. Every time I check my bank account online, I get a pop up that asks if I’m sure I don’t want to enroll in their overdraft protection program. You just have to say no and keep saying no.

80. Avoid other fees. Businesses these days seems to be nickel and diming consumers any way they can with extra fees. Banks, airlines, and credit card companies are the big culprits. Be a responsible and savvy consumer and you can avoid most of these fees. Use ATMs in your bank’s network to avoid ATM fees and pay your bills on time, always. And fly Southwest! No extortionist baggage fees, friendly service, and one of the best safety records in the biz (recent holes in the plane notwithstanding).

What are some more ways to save money and be frugal?Thursday, May 26, 2011

5 Steps to The Finish Line

How to Turn Your Dream Into a Plan In Five Simple Steps

Posted: 20 May 2011 05:47 AM PDT

I’m sure you have plenty of dreams for your life. They might bubble away at the back of your mind. They might loom in your thoughts all day. They might even keep you awake at night.

Dreams can be powerful, encouraging and even a bit scary. A dream alone, though, isn’t going to get you far.

What you need is a plan.

And if that sounds too boring, think of it this way: if you want to actually have that dream, a plan is the map that gets you there.

Here are five steps for turning that vague dream into a concrete plan:

Step #1: Write Down Your Dream

How many of your dreams have you actually written down?

Perhaps the idea of committing your dreams to writing is a little frightening. Don’t resist doing it. The act of putting something into words on paper (or in a computer document) suggests that you’re committing to it – and this can be very powerful in helping you eventually achieve that dream.

Even better, when you write something down, you’re forced to think it through. That vague dream of “have lots of money” has to become something firmer – perhaps “make $100,000/year” or “have $200,000 in the bank”.

Step #2: Brainstorm Some Possibilities

Whatever your dream, there’s more than one way to reach it. For instance, if you want to make lots of money, you could:

- Change careers to something more lucrative

- Work harder in your current job to get a promotion

- Go back to college and study for a degree

- Start up your own business as an entrepreneur

- Save up money and put it into a high-interest account

- Marry someone rich

- Buy a winning lottery ticket

Step #3: Pick One Clear Goal

Once you’ve figured out some possibilities, come up with one clear goal. You might decide, for instance, that your goal is to change to a particular career which will give you a $80,000/year paycheck.

Look for a goal which is perhaps challenging, but achievable. There’s no point in picking a goal which you’re convinced you can’t really manage – that’s just going to put you back in the world of dreams, where you constantly think about a better future without taking any action towards getting there.

Step #4: Give Yourself a Deadline

It’s much easier to hit your goals when you’re working towards a deadline.

Again, you want to be realistic here – but don’t be afraid to challenge yourself a little. If you’ve got a really big goal, you might want to look two – five years ahead. With smaller goals, you can probably achieve them within a year.

With the example of changing career, you might decide that three years is a realistic timeframe. It’s often helpful to tie your deadline to a particular event – perhaps your 40th birthday or Christmas 2014.

Step #5: Write Down the Steps to Get You There

And now we’re onto the plan itself. This is where you really get into the nitty-gritty and start turning that dream into something real.

With big goals, it’s often helpful to work backwards. So:

- What are the job requirements of that new career?

- How can you achieve them (e.g. take night classes)?

- Are there any pre-requisites for that (e.g. you need some money to pay for the classes)?

- How can you do that?

If you have any steps which you don’t know how to complete, try breaking them down further. Figure out exactly what you need to do to achieve your dream – and you’ve got a plan which really can change your life.

So – what’s your dream? And what’s the first step on your plan? Let us know in the comments.

| Written on 5/20/2011 by Ali Luke. Ali writes a blog, Aliventures, about leading a productive and purposeful life (get the RSS feed here). As well as blogging, she writes fiction, and is studying for an MA in Creative Writing. | Photo Credit: Drew Coffman |

Wednesday, May 25, 2011

Video Time: Time Lapse

El Cielo de Canarias / Canary sky - Tenerife from Daniel López on Vimeo.

An Alternative to Prejudice

A friend of mine wrote this and was looking for a place to post it.

Once I read it, I stopped what I was doing and added it to this site to appear today.

My Dad and my Uncles served our country in the military and every year we would attend our local Memorial Day Parade.

It was the right thing to do.

One thing I will not do is racial discrimination. We need to stop looking for differences and look for similarities.

Now, read on:

Prejudice is Alive and Well in 2011 - Unfortunately

I was enjoying a pleasant experience at a suburban men's clothing store the other day. My sales person, John was enthusiastically taking my money and I was excited about the clothing he had up-sold me. I only went in for a shirt…the alterations on my new sport coat and 2 pair of slacks would be ready in 2 days.

John was interrupted by another salesperson,”He doesn’t want me to wait on him.”John said,”What?” and was answered, “He wants his own kind.” John stopped and looked at the other employee and said, "Excuse me?" The employee repeated, "He doesn't want me to help him."

This is 2011. I'm shopping in a nice, suburban neighborhood, retail outlet. The customer refusing help is a clean-cut, well-groomed, professional-looking, 30 something. Is this for real?

With clenched jaw, John went to the stores manager. The manager helped the customer.

The employee who had been refused was a 70-year-old retired military man. He fought for our country and defended us all.

If you Google “Hate Groups,” there are over 900 hate groups listed. Should we start a dexteresque hate group–a hate group that hates hate groups? Well...no. It’s a reminder that racism continues to exist. It can be anywhere and is everywhere. It is the responsibility of people to work against it, and it starts with our children. Do not assume they know what is right – teach them, and show them.

When I was 13-years old, my parents owned and operated a neighborhood convenience store. A small cafeteria was attached to the store. Mom ran the cafeteria and dad ran the store.

The cafeteria did a lively lunch business supported by a few local businesses. One warm summer day, a local power company service crew stopped to eat. One member of the service crew was an African American (back then, he was black). Several regulars from a local gravel operation began heckling the man, "You know where the colored section is? It's out in your damn truck you ___!” The heckling became worse. My dad took off his white store apron, handed it to me, and asked me to run the register. He was going to lunch. My dad went through the line, got a tray of food and sat down with the African American man. It was a lesson. The cafeteria closed a short time later. It had been black- balled. Over the years, my dad taught me we all have prejudices, but must understand they are wrong and work to change them. Teach your children.

Here are several tolerance teaching organizations including:

Anti-Racist Parent, Teaching Tolerance, Character Education, and the Civil Rights Project. http://greatergood.berkeley.edu/greatergood/2008summer/PrejudiceResources.pdf

Like I said, the author of the above article is a friend who needed an outlet for what he wrote.

Feel free to use the buttons below to share with others.

Tuesday, May 24, 2011

Tech Tip Tuesday

At the radio stations I work for, it is too common a practice to send a note to lots of people, and then when individuals reply to it, they hit Reply All.

Sometimes that it is a good thing.

Usually not.

MarketingProfs.com sent an email on this subject, and then I'll have a couple of my own tips afterward.

How and When to 'Reply All'

|

The "reply all" button can produce all kinds of headaches—from filling inboxes with unnecessary chatter to damaging a brand's reputation. "Unwitting or careless use of reply all spawns much mischief," writes Simon Glickman of Editorial Emergency, "from the accidental broadcasting of remarks intended for only select recipients to the dreaded 'e-storm,' whereby an innocent note to the wrong list unleashes wave after wave of indignant, 'helpful' and other replies."

So how do you balance "reply alls"' negative potential with the need to keep your colleagues in the loop? Consider this advice:

- Before hitting "reply all," take a few seconds to consider how your comment actually adds to the conversation. That witticism, zinger or praise—however clever or complimentary—might be irritating in the context of a public forum.

- If multiple recipients don't need to see everyone else's feedback, prevent a flurry of inbox-clogging responses with an explicit request not to reply all.

- Remove the temptation to "reply all"—hide addresses in the BCC field.

Most important, though, don't start flame wars by giving public smackdowns when others violate the etiquette you so carefully observe.

"I sometimes even draft such responses in high dudgeon, hammering out a few paragraphs of doctorly derision before the better angels of my nature touch down on the delete button," admits Glickman. "The impulse to burn someone publicly is sometimes overpowering, but I've never regretted resisting it."

The Po!nt: Avoid the pitfalls of "reply all" email conversations by keeping it professional and business-like; in the process, your colleagues might just get the clue.

Source: Editorial Emergency.

Me again.

If someone sends me an email with lots of other peoples emails that I might want for future reference, I sometimes use the reply all button with a simple "Thanks".

When I send that email, my email program saves all those emails addresses in my address book automatically, and I've just increased my list of contacts.

Monday, May 23, 2011

Video Time: 31,536,000

Here it is compressed into 40 seconds:

One year in 40 seconds from Eirik Solheim on Vimeo.

Sunday, May 22, 2011

That "Other" Generation

This is the due date for my first grandson.

Anytime now I will officially be a grandfather.

I will move one more rung on the generational ladder.

There are a lot of misconceptions about each generation, and working in the advertising business, with 4 different stations, each targeted to a different demographic, I hear a lot of them.

I have friends who range from their 20's to nearly 70 so I've learned the danger of stereotypes.

Let's clear up a few about my kids generation with this report from PRDaily:

10 myths about millennials

As a natural towhead, I’m a walking punchline for dumb-blond jokes.

Fact is there’s no connection between my stupidity and the luscious locks atop my head. I’m dumb for a whole other set of truths, above and beyond my blond hue that salon colorists can only dream about.

That’s the problem with stereotypes. The connection they draw—in this case, blond equals stupidity—is tenuous at best and fails to account for other circumstances.

As we’re talking stereotypes, I’d like to take this opportunity to confront a few more—the ones that people my age confront

Let’s clear up some of the myths about the children of the ’80s, by taking this 10-question quiz. It’s true/false, so you at least have a 50 percent chance on each question. No. 2 pencils ready, and …. begin:

1. Millennials are easily distracted, thereby affecting their work ethic and professional demeanor.

FALSE: Don’t confuse “distracted” with “uninterested.” We don’t like to waste time, as we’ve been bred to believe time is money. If we were easi …. wait, where were we?

2. Millennials always look for the easy way out.

FALSE: Otherwise, I’d have passed this assignment from my editor on to someone else, or found a post online from someone who’d already covered the topic. I didn’t even bother looking for anything of the sort.

3. Millennials are radical liberals.

FALSE: I am, but I don’t recall having those unintentionally drunken political debates at 3 a.m. by myself. From what I remember, there was a conservative about my age across from me.

4. Millennials are unconcerned with worldly affairs.

FALSE: How do you think bin Laden’s death and the royal wedding became trending topics on Twitter?

5. Millennials are snarky, self-indulged narcissists.

FALSE: I just wrote about this on my Twitter account, where you can follow me @iquotesometimes. I’ll also have an unwritten memoir, as well as an untitled one-man show coming soon. I know—without “me,” it’s just aweso.

6. Millennials are the future.

TRUE: As was the generation before us, and the generation before them, and the generation before them. It’s nothing special. It’s just how it goes.

7. Millennials are great team workers.

TRUE: Though past generations might’ve adhered to a sink or swim, survival of the fittest attitude, millennials are social creatures who have always been taught to play nice with others and work as a group—even when their professor stuck them with the worst of the worst in COM 317.

8. Millennials are perhaps the most diverse, progressive generation in U.S. history.

TRUE: From their political stance to their attitude toward equal rights, not to mention their very demographic makeup, millennials stand at the brink of a more global society that’s less ethnocentric than its predecessors.

9. Millennials never finish what they start.

FALSE (but TRUE in this case): Of course we finish things. I finished undergrad, and it only took me seven short years. Kidding—six-and-a-half. However, I decided not to finish this post, which is why we’re ending this list at No. 9 instead of giving you the full 10. What do you want from me? “The Voice” is on.

10. Millennials fight authority.

FALSE: My editor told me there had to be a No. 10.