I decided to break it up into 4 parts. See if you can find some ideas to apply to your life:

-

Win the War on Debt: 80 Ways to Be Frugal and Save Money

The manliness of frugality cannot be overstated. Frugality cultivates the manly qualities of independence, self-reliance, self-sufficiency, simplicity, and minimalism. It keeps a man free from the enslaving chains of debt and gives him an sense of manly pride and satisfaction. Frugality build a man’s immunity to the siren call of “stuff,” helps him learn to make do with less, and adds pleasure and happiness to his life by providing opportunities to practice delayed gratification. Frugality also fosters the DIY spirit and inspires a man to create, instead of consume.

We could wax long and poetic about the manliness of frugality but let’s get down to the brass tacks: how does a man become frugal? Some men, inspired to jump on the frugality wagon, set a drastic course for themselves and turn theirs live inside out. But inevitably, this man ends up chafing at the extreme constrictions he has set for himself, burns out on the program, and sets off on a shopping spree to compensate for the months of rigid restraint. No, the better course is simply to make little changes throughout the different areas of your life. You will be surprised to see how fast these small changes can add up and leave you with extra moola in your pockets and in the bank. And you also might be surprised to find out how fun being frugal is–really! It becomes like a game where you’re always trying to figure out ways to cut costs.

We’ve created this list of 80 practical–and often pretty painless–ways to save money. Whether you’re looking to trim your debt, live more simply, start an emergency fund, or just need to find ways to offset the hole in your budget created by rising gas prices, there are guaranteed to be a few things here you can start implementing in your life right away. I recommend giving these ideas a look-0ver, making a list of ten of more things you can give a go, and putting them into practice as a new month begins.

Victory over debt is at hand!

Health and Fitness

25. Ditch the gym membership and create a DIY Gym. Also, rediscover the joy of the garage/basement weight set.

26. Bodyweight exercises. Check out our guide with 35+ different push-up exercises. We also have a burpee guide with different routines you can do.

27. High deductible insurance+ health savings account. If you and your family are healthy, you might consider switching to a high deductible insurance plan and opening up a health savings account along with it. While you have to pay more out-of-pocket before coverage kicks in, the premium you pay each month can be considerably less than regular plans. The health savings account you open along with your high deductible plan allows you to set aside money tax free that you can only use for medical expenses. You use the money in your health savings account to pay co-pays, deductible expenses, and medications. The lower premiums of a high deductible plan plus the tax savings of an health savings account can mean big time health insurance savings.

28. Get samples from your doctors. Most docs are happy to fill a bag for you with a bunch of samples of the medication you need.

29. Take care of yourself. The healthier you are, the less likely it is that you’ll have to make visits to the doctor and spend money on medications. Exercise and eating right are simple things you can do to stay healthy and reduce medical costs. Also, take care of your teeth. Dental corrections like fillings and root canals can cost an arm and a leg. Invest three minutes of your day, morning and night, to proper dental hygiene.

30. Stop smoking. Last time I checked a carton of cigs was going for $20+. Besides the money you save by not buying a carton every week, you’ll also save money on health costs in the long run.

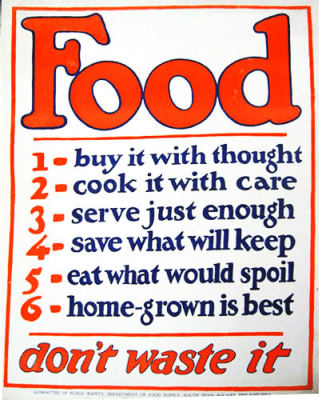

Food

31. Shop with a list. Studies show that when you shop with a list, you spend less than if you don’t, as it helps you concentrate on picking up only what you need.

32. Brown bag your lunch. It’s not only cheaper, it’s usually a heck of a lot more healthy than going out to a restaurant.

33. Cut back on packaged and convenience foods and learn how to make cheap meals yourself. Pasta. beans. Eat them.

34. Make leftover friendly food. Casseroles and crock pots are your best friends here.

35. Make your own coffee. Time to break-up with your favorite barista.

36. Drink more water. Water is free, and it’s good for you. Drink it instead of flavored beverages that cost money and pad your waistline.

37. Limit going out to eat to one time a week or less. And when you do go out, split America’s massively-sized portions in half and use a coupon.

38. Grow your own vegetables. Can’t do this right now because we live in apartment, but it’s a future goal. I have friend who has had tremendous success with growing his own vegetables. He saves money, and he says it makes him feel like a homesteader.

38. Grow your own vegetables. Can’t do this right now because we live in apartment, but it’s a future goal. I have friend who has had tremendous success with growing his own vegetables. He saves money, and he says it makes him feel like a homesteader.

39. Buy store brands. Here’s a secret that brand name companies don’t want you to know: sometimes generic brands are made at the very same factory as the brand name product, they just put a different label on it. Sometimes this isn’t the case, and the generic really is inferior in quality. So just do some experimenting to see what works.

40. Have a weekly menu. I don’t know about you guys, but when Kate and I don’t have a menu planned out, when the question of “What are we going to eat tonight” rolls around, it’s pretty easy to respond with “Let’s go out.” A weekly menu can help you reduce the amount of times you go out to eat, thus saving you money on expensive restaurant food.

Part 3 next Friday!

No comments:

Post a Comment